Fitch Ratings, a prominent credit rating agency, has made a significant adjustment by downgrading Ethiopia’s Long-Term Foreign-Currency (LTFC) Issuer Default Rating (IDR) from ‘CCC-‘ to ‘CC’. Simultaneously, the agency has reaffirmed the Long-Term Local-Currency IDR (LTLC) at ‘CCC-‘. This downgrade underscores Fitch’s deepening concerns regarding Ethiopia’s diminishing external liquidity, escalating external financing gaps, and the heightened likelihood of a default event.

The external liquidity of the nation is under considerable strain, with projections indicating sovereign external principal and interest payments of USD 1.0 billion in the fiscal year ending in July 2024 and USD 2.0 billion in FY25. Adding to the financial challenges, Ethiopia faces the maturation of a USD 1 billion Eurobond in December 2024.

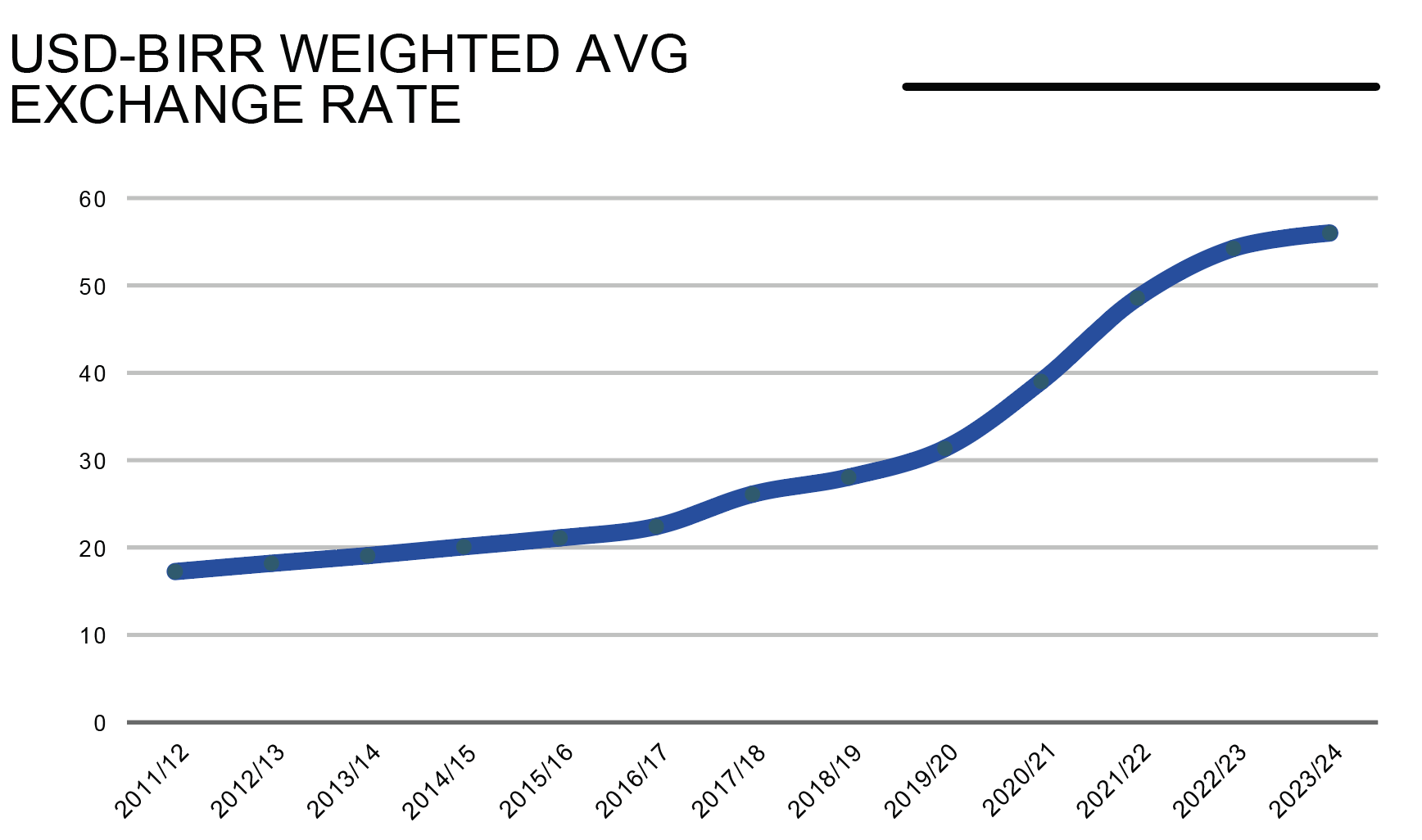

Over the past three years, Ethiopia’s structural external imbalances have worsened, primarily due to various shocks and disrupted external loans. While the country has made efforts to narrow the structural current deficit (CAD), the parallel market exchange rate suggests room for a more substantial adjustment of the official exchange rate.

The government’s participation in the G20 Common Framework (CF) debt relief initiative introduces the potential for a default event. Delays in securing financing from international financial institutions and a lack of progress on the CF further contribute to Ethiopia’s deteriorating external liquidity.

At home, the government heavily relies on domestic financing sourced from the banking sector, leading to an increase in interest service costs. Despite a narrow general government fiscal deficit of 2.6% of GDP in FY23, revenue collection constraints and substantial humanitarian and reconstruction spending are expected to drive sizable fiscal deficits in FY24-26.